irs child tax credit 2021

Most families received half of the credit in advance via monthly payments last year but theres still more money to be claimed. Taxpayers will begin to receive.

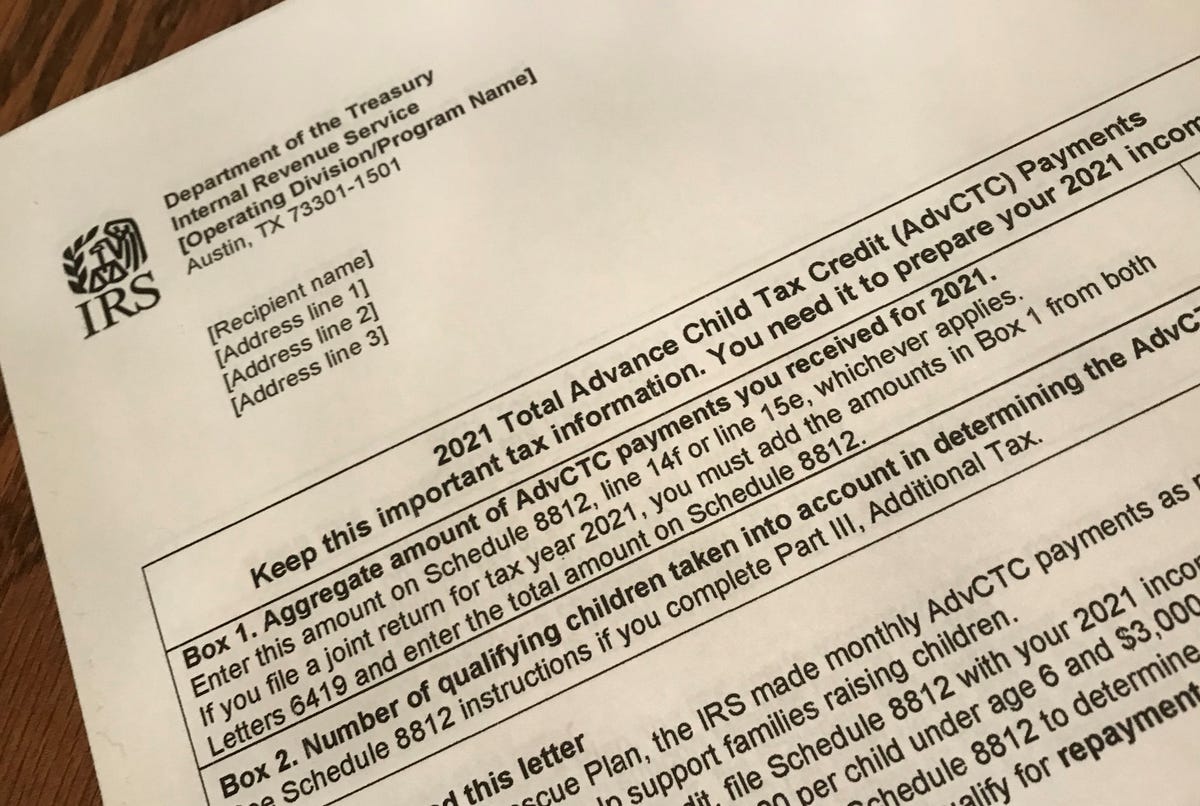

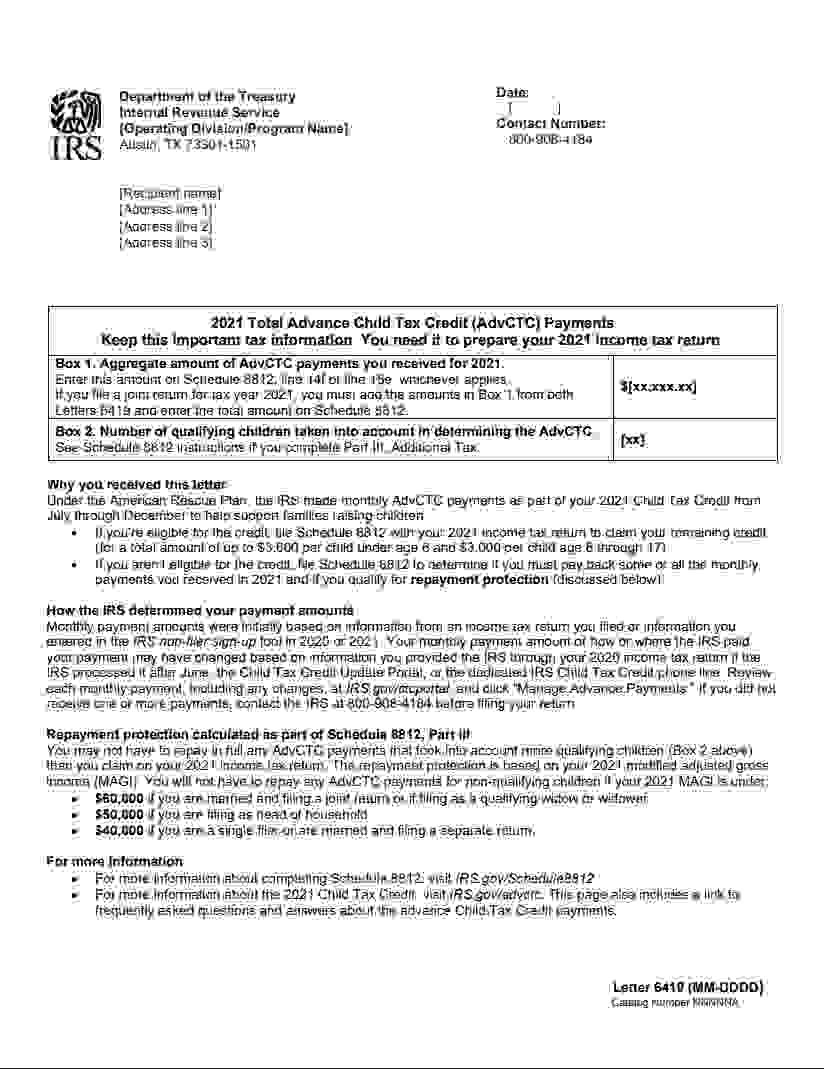

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic.

. The age for children. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Calculation of the 2021 Child Tax Credit These updated FAQs were released to the public in Fact Sheet 2022-17 March.

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. For 2021 the credit amount is. The child tax credit for the 2021 tax year is.

Beginning with your tax year 2021 taxes the ones filed in 2022 now you get additional CTC of the amount of 1000 1600 in some cases to the already allowed 2000 of. The maximum expenses eligible for the credit. In previous years 17-year-olds werent.

This means that by accepting advance child tax credit payments the amount of your refund may be reduced or the amount of tax you owe may increase according to the IRS. Lowers the phase out rate. Resident alien You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

The IRS will send you monthly payments for half your new credit between July and December 2021. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children.

One of the most significant changes for 2021 was to the child tax credit which is claimed by tens of millions of parents every year. You or your tax preparer if you use one can use. After logging in simply click View my tax records to see your advance child tax credit payments and number of qualifying children for 2021.

The last return filed. In addition the qualifications for the. 150000 if married and filing a joint return or if filing as a qualifying widow or.

President Joe Biden in March. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. A group of Democratic senators on Thursday called on the IRS to extend the filing deadline for taxpayers without a Social Security number to obtain the enhanced child tax credit.

The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. The IRS will automatically prepay half of the 2021 child tax credit to eligible taxpayers based on their 2019 or 2020 tax information ie. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

This is a significant increase. The CTC amount will start to gradually decrease. The new and expanded child tax credit was included in the 19 trillion American Rescue Plan that was signed into law by US.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. Our phone assistors dont have information beyond. The credit amounts will increase for many.

Have been a US. The 2021 tax year resulted in the expansion of the child dependent care credit. The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per. More families were eligible for the credit than ever before. If you meet all the other rules for taking the child tax credit you can claim the credit for your d Form 1040 this year.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. The expanded child tax credit for 2021 isnt over yet. Do not call the IRS.

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Here Is How The Federal Interest Price Can Help Save The Economic Climate During A Recession Tax Refund Interest Rates Check And Balance

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Child Tax Credit What To Do If You Didn T Receive A Letter 6419 Marca

Child Tax Credit 2021 Changes Grass Roots Taxes

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Here S How To Opt Out Of The Child Tax Credit Payments

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com